- #1 Rated Online Provider of Finance and Banking Training

Unleash Your Potential. Power Your Career.

Expert-led finance and banking training and productivity tools to transform your ambition into reality.

Save Up To

Achieve Your Career Foals With CFI's Industry- Leading Finance Traning

Join the 2 Million Professinals Who Trust CFI

Equip Yourself and Your Teams for Peak Performance

Master In-Demand Skills

Hands-on learning that simulate the complexities of modern finance roles.

Learn Anywhere, Anytime

Learning that adapts to your schedule. For busy professionals & hybrid teams.

Upskill Teams at Scale

Fast-track new hire readiness, bridge skill gaps, and maximize training ROI.

Showcase Your Skills in Interviews and at Work

Build a portfolio of hands-on projects to prove your expertise and job readiness.

Full-Immersion

Enjoy all the features of self-study, plus get 1-on-1 guidance, financial model reviews, and exclusive offers.

Self-Study

Get unlimited access to courses, certifications, specializations, and comprehensive financial models.

Company

About CFI

Meet Our Team

Careers at CFI

Editorial Standards

CPE Credits

Learner Reviews

Partnerships

Affiliates

Higher Education

Newsroom

Certifications

FMVA®

CBCA®

CMSA®

BIDA®

FPWMP™

ESG

Leadership

Excel

CFI For Teams

Financial Services

Corporate Finance

Professional Services

Support

Help | FAQ

Legal

Community

Member Community

What’s New

Resources

Podcast

CFI Review (2024): Is It Worth It?

The Financial Modeling & Valuation Analyst is the premiere certification offered by the Corporate Finance Institute. With over 100,000+ student enrolments each year from 170 countries, it is certainly witnessing a surge in popularity. The FMVA is a relatively new certification, but it has still managed to outpace most of its competitors in generating interest from the industry. Part of that popularity has to do with their unique modular content structure which makes it suitable for a LOT of finance and banking roles.

But just how much will the FMVA help your career? Is it worth the time commitment and the cost? How does it compare with other popular certifications? These are question that you should be asking before you commit to any course or certification.

Is CFI Legit?

First things first.

Many of us will have this question whenever we want to take any online learning program. Is this learning platform legit?

You might have this question about CFI as well (because I too had it 😂).

So, is Corporate Finance Institute legit? Gimme a minute, I’ll explain.

CFI was founded in 2016 by Tim Vipond, Scott Powell and Lisa Dorian. Currently, Tim Vipond is the chairperson and Scott Powell is the chief content officer at CFI. You can find more about the team behind CFI here.

In 2021, CFI received funding from two lead investors in the industry. In the same year, Corporate Finance Institute reached the milestone of 1 million students and also acquired Macabacus.

CFI is currently valued at over $100 million.

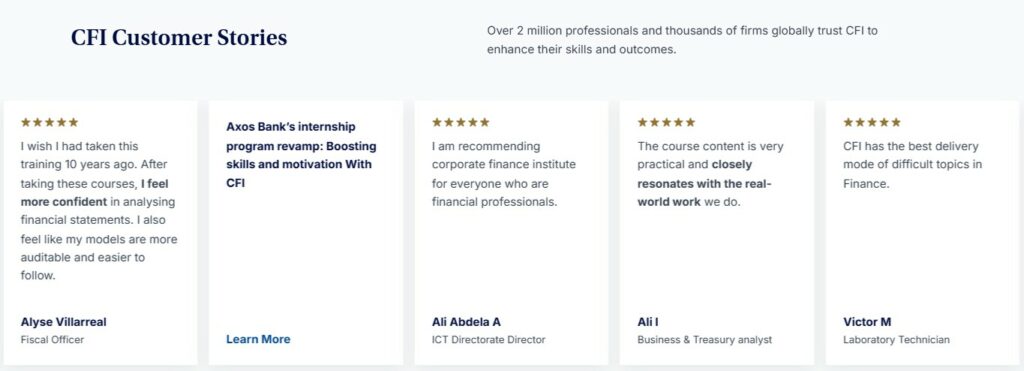

Over the years, CFI has positioned itself as one of the biggest financial education provider. Their courses and certifications are well-regarded within the industry.

So yes, it is a legitimate organization in the finance education space.

Pros and Cons of Corporate Finance Institute

Positives

Expert-Led Learning: CFI courses are taught by knowledgeable professionals with industry level experience.

Comprehensive Curriculum: Offers a complete learning package covering a variety of finance topics.

Real-world Relevance: Focusses on practical skills like building financial models. Equips us with the tools knowledge that is necessary for real-world scenarios.

High-quality Coursework: Delivers in-depth course content that is relevant to finance industry standards.

Valuable Certifications: CFI certifications, particularly the FMVA, are recognized in the finance industry.

Online Community: Allows us to interact with the CFI instructors and fellow learners.

Negatives

Time commitment: Takes a lot of time (3-6 months) and effort to complete a certification program.

Expensive Membership Fee: The cost of a CFI membership plan is high. Particularly the full-immersion plan that comes with one-on-one guidance.

Technical Issues: Sometimes videos may take too long to load or quizzes might not work right. It can make learning a bit bumpy.

Missing Soft Skills: CFI’s technical training is great, but it would be even better with more focus on soft skills like communication.

CFI Course Effectiveness

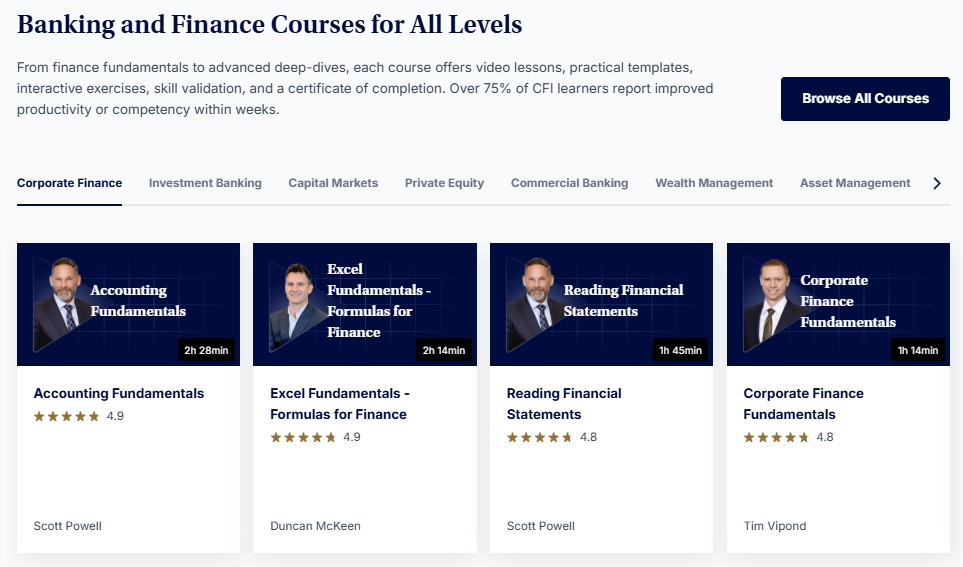

CFI offers a wide range of courses and certifications to improve our finance skills.

We can learn about financial modeling, financial analysis, capital markets, financial planning, and a lot more.

I love CFI’s coursework and curriculum design. Their programs are well-organised.

Imagine building a house. You wouldn’t start with the roof, right? You’d start with the foundation, then add the walls, the roof, and so on.

CFI programs are like that. Their courses and certifications are set up really well. They begin with easy stuff and then add complex topics step by step. Each part connects to the next one, so it feels like you’re always learning more and getting better.

You’ll never feel lost in their courses. They’re like a roadmap that guides you from start to finish.

Trust me. This is something which we can only see in a very few finance learning platforms.

The real world case study in each program is amazing. But it would be better if there were more case studies. I just wish they add more in future.

Their course content also gets updated to reflect current trends and best practices. So you’ll always have the newest finance knowledge and skills you need to succeed in this field.

Are CFI Certifications worth it?

CFI offers a diverse range of certifications covering various aspects of finance.

CFI finance certifications are for all kinds of people. It has something for everyone, whether you’re starting out and learning the basics or you’re a pro looking to boost your skills.

Each CFI certification program boasts a rigorous curriculum meticulously designed by industry experts.

CFI’s certifications are highly regarded for their alignment with industry standards and practices.

A hallmark of CFI certifications is their focus on practical skill development. CFI equips you not only with theoretical knowledge but also with the tools and techniques needed to excel in your job. This emphasis on application sets CFI certifications apart in the industry.

CFI certifications hold some weight in career advancement. They serve as tangible proof of acquired skills and expertise. It enhances your resume and credibility in job applications within the finance industry.

Now lets get to the point. Are these CFI certifications worth it? Definitely! CFI certifications equip you with practical skills and industry-relevant knowledge. So it is worth it if you want to develop your finance skills.

Currently, there are 6 different CFI certifications.

Before we dive into each certification individually, let me tell you how their certification programs work.

When you enroll in a CFI certification, the first step is to take the prep courses. It is optional but I’ll strongly recommend you to go through it to understand the fundamentals of finance. So that you’ll be ready for next level advanced topics.

Once you’re done with the prep courses in a certification, you’ll be ready to take the core courses. These core courses will give you a strong foundation in a specific subject.

After completing the required core courses, you can take elective courses in a certification. In these elective courses, you’ll learn more advanced concepts of that particular subject.

Throughout the program, there’ll be interactive exercises and quizzes. You’ll also explore case studies.

All of this will make you ready to take the final exam associated with that specific certification.

You can take the practice exams as many times as you want but the final exam can be attempted only once for every 30 days if you fail.

Please note that the minimum passing grade for a CFI certification exam is 70%.

After completing the courses and final exam, you can get your CFI certification. You’ll receive a blockchain-verified certificate.

You also have an option to get a CFI physical certificate at an additional cost of $97.

1. Financial Modeling & Valuation Analyst (FMVA) Certification

This is CFI’s most popular and oldest certification program that was launched back in 2017. But since then, it has only garnered widespread recognition for its rigorous curriculum and practical approach.

If you want to become a financial analyst, then this FMVA certification program will be very useful for you to develop relevant skills.

Tim Vipond, Scott Powell, Duncan McKeen and Jeff Schmidt are the instructors for this FMVA program. They have done a fantastic job here. Every concept was explained crystal clear.

You need to complete 17 courses and final exam to earn your FMVA certification. There are 14 core courses and 19 elective courses. You need to complete all the core courses and 3 courses from the electives. There are more than 200+ exercises and it was actually more engaging.

Pro Tip: Don’t miss the Amazon case study in electives. It was fun and full of insights.

It might take around 3 to 6 months to complete this certification program successfully. It’ll change based on your time availability.

One fourth of the CFI FMVA certification program content is focussed on financial modeling.

You’ll learn how to:

- Build and analyze financial models for various purposes like company valuation.

- Communicate financial information effectively and professionally.

- Make informed investment decisions based on financial analysis and valuation techniques.

- Use advanced financial modeling techniques such as discounted cash flow (DCF) analysis.

You’ll also learn about financial statements, different valuation methodologies, forecasting techniques, advanced data visualization techniques and more.

2. Commercial Banking & Credit Analyst (CBCA) Certification

This program focusses more on financial analysis and credit structuring.

You have to complete 19 courses and pass the final exam to get your CBCA certification from CFI.

You can make use of the 12 optional prep courses to learn about the credit and lending basics. You’ll know everything about credit analysis and loan underwriting after completing the 16 core courses.

You need to complete all the core courses and 3 out of the 25 elective courses. I chose Asset-Based Lending & Alternative Finance, Lending to Complex Structures and Syndicated Lending in the electives to learn about the lending concepts.

The 6 case study challenges in the CFI’s CBCA certification program was also extremely useful to understand how things work in the real world.

This program will help you develop the skills you need to become a credit analyst, commercial banker, private lender, etc.

3. Capital Markets & Securities Analyst (CMSA) Certification

You need to complete the 8 core courses and a minimum of 7 out of 25 elective courses to earn your CMSA certification.

More than 50% of the content is about derivatives and fixed income.

By the end of the program, you’ll know how derivatives work. You’ll also learn about equity markets, fixed income markets, foreign exchange markets and analytical methodologies.

There are optional case study challenges in this CFI certification program. You can also use that to get a better understanding of some technical analysis tools and how options traders construct trading strategies.

You’ll see many instructors in this program like Tim Vipond, Andrew Loo, Guy O’Loughnane, Meeyeon Park, Paul North and Scott Powell. It’s a good sign because we’ll be learning various topics from experts with actual industry knowledge in their domain.

This program will help you in acquiring the skills to get into asset management, wealth management, risk management, sales and trading careers.

4. Business Intelligence & Data Analyst (BIDA) Certification

CFI’s BIDA certification courses is all about data transformation, data visualization and data modelling.

And you’ll learn some basic coding stuff with a focus on python and SQL.

Throughout the program, you’ll also get to learn a lot about popular business intelligence tools like Microsoft Power BI, Tableau, Excel and more.

The course about each tool comes with a detailed case study to help you practice what you learn.

All the courses in this program are focused primarily on popular BI tools, but I’d love to see them add content to learn about fast growing BI tools like Qlik.

CFI brings in BI & Data experts to deliver this program. You’ll learn from Sebastian Taylor who has more than 10 years of experience in business intelligence and data analysis, Joseph Yeates, Pavel Nacev and many others.

To earn your BIDA certification, you need to complete all the 15 required courses and attain the minimum passing grade of 70% in your final exam.

This certification program is for you if you’re looking to gain relevant skills to become a BI developer, business analyst, data analyst, etc.

5. Financial Planning & Wealth Management Professional (FPWM) Certification

The Financial Planning & Wealth Management Professional (FPWM) certification was launched by CFI in the year 2022.

If you’re ultimate goal is to become a investment advisor or financial planner, then CFI’s FPWM certification program can help you in gaining relevant skills.

In the 12 core courses of this program, you’ll learn everything from 7-step financial planning process to portfolio management and insurance planning.

The FPWM program covers a comprehensive range of topics, enabling us to:

- Gain a thorough understanding of financial planning principles and processes.

- Master various investment management strategies and asset allocation techniques.

- Develop expertise in risk management.

- Build and manage a successful wealth management practice.

- Build strong client relationships.

- Stay updated with the latest trends and regulations in the financial planning industry.

In addition to the core courses, you have to complete a minimum of 4 elective courses to get your FPWM certification.

There are more than 80 interactive exercises in this program. So we have an opportunity to learn by performing tasks that’ll be similar to real-world scenarios.

6. FinTech Industry Professional (FTIP) Certification

Considering the significant growth of the FinTech industry, CFI recently came up with this FTIP certification program. It is designed by experts in a way to help us keep up with the fast changes in this growing field.

FinTech Industry Professional (FTIP) certification program will be extremely useful in acquiring the necessary fintech skills to start your career in this sector.

Across the 23 courses in this program, there are more than 70 hours of learning content and 160+ interactive exercises.

However, to get your CFI FTIP certification, you just need to complete the 13 required courses.

Completing the prep courses, 10 core courses plus 3 out of 4 elective courses is enough to take the final exam.

The FTIP program will be equipping you with the skills and knowledge to:

- Understand the core principles and key drivers of the FinTech revolution.

- Analyze the impact of FinTech on various financial sectors like banking, insurance, etc.

- Explore cutting-edge technologies like blockchain and its applications in FinTech.

The optional practice labs in this program will be helpful to learn about NFT minting, building Robo-Advisor and InsurTech Pricer.

Are CFI Instructors Credible?

Good thing about CFI is that they explicitly mention about the instructors in a course page. So we’ll know who is going to teach us. This gives us an opportunity to verify them personally and we can even connect with them through LinkedIn.

Based on my experience, I can say that all the CFI instructors are seasoned finance professionals with extensive experience in their respective fields.

This ensures that you receive practical, real-world knowledge from individuals who have actually applied those concepts in their careers.

Their instructors have backgrounds in investment banking, corporate finance, private equity, wealth management, FinTech, and other relevant areas. This diversity of expertise adds valuable perspectives to the learning experience.

There are many expert instructors at CFI. Depending upon the specific course topic, the instructors will vary. And I just love this.

Tim Vipond is my personal favourite instructor at CFI.

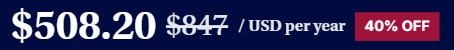

CFI Pricing and Plans

CFI Plans for Individuals

CFI offers two membership plans for individuals.

The Self-Study plan costs $497 per year. This is a good option if you’re comfortable learning on your own.

The Full-Immersion plan costs $847 per year and it comes with a lot of additional benefits such as expert guidance and premium career resources.

Both the plans will give you full access to CFI’s on-demand learning library. So you’ll get access to 180+ courses, 6 certifications, and 10 specialization programs. However, there are some key differences between the two plans.

The CFI Full-Immersion plan includes everything in the Self-Study plan, plus:

- Fin chatbot: AI guidance and support in 25+ languages for all CFI courses.

- One-on-one guidance: Get curriculum questions answered by CFI instructors (5 per week).

- Model Feedback: Get your financial models reviewed by experts (1 per week).

- Resume Boost: Get your resume/CV and cover letter reviewed monthly.

- Premium Toolbox: Access 100s of premium templates, guides, and cheat-sheets to work smarter.

- Exclusive Deals: Get discounts and free access to top tools like Macabacus, Capital IQ, Refinitiv, FinChat and Vertical IQ.

CFI Self Study vs Full Immersion: Which plan should you choose?

The self-study plan ($497) is perfect if you’re just dipping your toes into finance or working on a tight budget. You get access to all CFI courses but work at your own pace without much guidance.

The full immersion plan ($847) is worth the higher investment if you’re serious about breaking into investment banking or similar roles since you get 1-to-1 expert guidance which can be super helpful when you’re aiming for those competitive positions.

Go for self-study if you’re a self-motivated learner wanting to skill up gradually, but choose full immersion if you need more guidance, accountability, and want to accelerate your learning through engagement with finance experts.

Think about what you need and how much you’re willing to pay, then compare the CFI plans to find the best fit.

CFI Plans for Teams

CFI offers two main pricing plans for teams: Basic and Premium.

The Basic plan will cost $399 per learner annually. You can get access to 180+ on-demand courses with 5,000+ video lessons. You can set up learning paths for your team members or use the role-based learning paths provided by the experts.

The Premium plan provides unlimited access to all the CFI certifications, courses and specialization programs. You’ll get everything from the basic plan plus additional benefits like dedicated account manager, blockchain-verified course completion certificates, etc. This CFI premium plan (for teams) will cost $497 per learner.

Go with the Basic plan if your team just wants CFI’s courses for online learning to upgrade the skills. If there’s a need for personalized guidance from CFI experts, premium plan would be better.

Ultimately, the best CFI plan for your team will depend on your specific needs and budget.

CFI Review: Final Verdict (My Opinion)

Will I get a job after completing a CFI program? This is one of the most common question that I receive from a lot of people.

Let me get this straight.

CFI isn’t a magic money wand. Success in finance ultimately depends on your individual skills, experience, and market conditions.

CFI gives you the skills and resources you need, but it’s up to you to put in the effort and make it happen.

There’s no guarantee you’ll get a new job or promotion with a CFI certification.

So set your goals clear before you jump into it.

But for the skills you’ll learn from the CFI courses, it is definitely worth it.

CFI’s courses and certifications are well known for building a strong foundation in various financial concepts. So if you’re a beginner in finance looking to start your career, CFI might be a gold mine for you.

Even if you’re already a finance pro, CFI’s specialized courses can make you even more awesome. They’ll boost your skills and open up exciting new paths like FinTech.

If you want face-to-face live classes, CFI’s self-paced fully online approach might not align with your learning style.

CFI is a commitment. Building financial expertise through CFI takes time and dedication. If you’re looking for a magic potion to overnight success, you might need to explore other options.

CFI’s dedication to delivering quality finance education is evident. But whether it’s the right fit for you depends on a lot of other factors.

So first consider your goals, schedule, budget, prior finance knowledge and learning style. Individual experiences will always vary, so take some time and analyse it. Weigh the cost of your time and money against the benefits you’ll receive from the CFI programs. Do this and you’ll know if CFI is a right investment for you or not. I hope this Corporate Finance Institute review helps you in that analysis to make the right decision.